The Reputation Constant: Dr. John Scarlett on Leading Biotech Through Change

A CEO’s Take on Building Biotech Through Uncertainty.

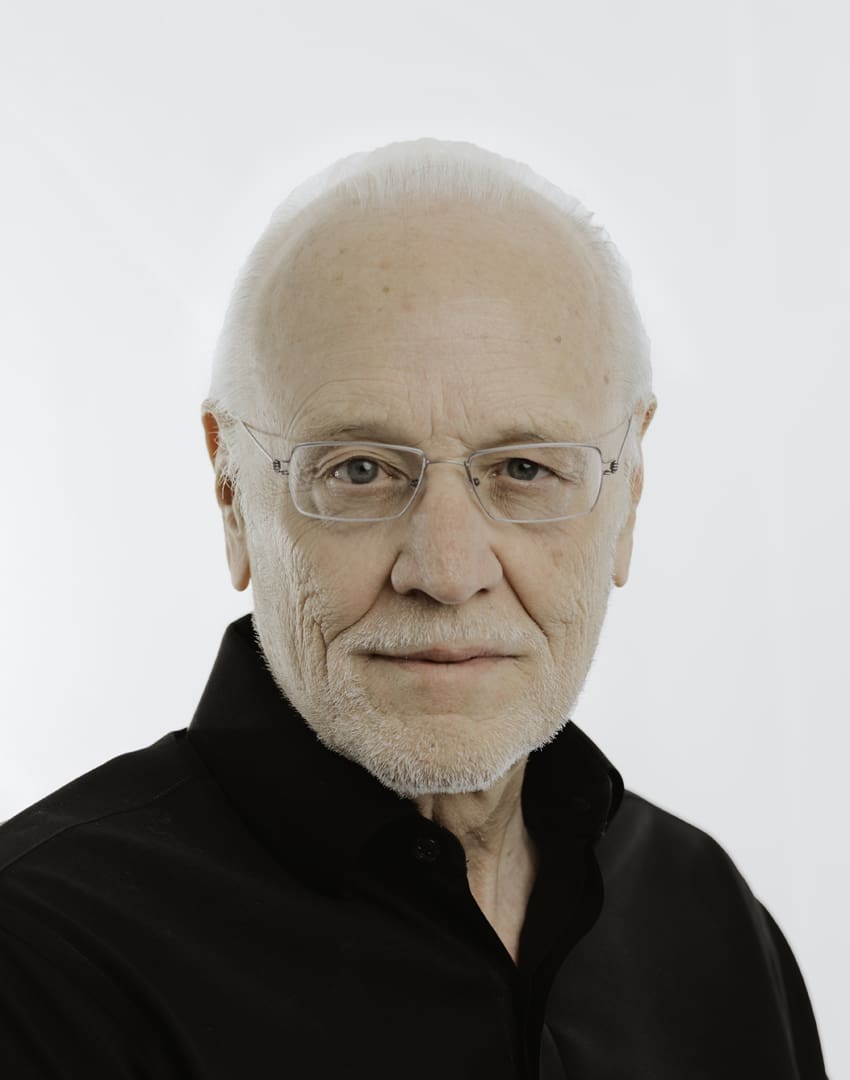

An accomplished physician-scientist and CEO, Dr. John “Chip” Scarlett is known for his clarity of vision, calm under pressure, and deep respect for reputation—the most valuable currency in biotech.

Outside of work, he’s a renowned underwater photographer and competitive car racer—pursuits that reveal the same precision, curiosity, and courage that have shaped his career.

Over three decades, Chip has led companies that thrive through challenge and change. His track record includes building and exiting Tercica, Proteolix, and Sensus, helping launch the CRO Covance, and most recently, transforming Geron from an R&D organization into a commercial-stage company.

He’s seen the industry from every angle—founder, CEO, dealmaker, and board member. And through it all, one principle has remained constant: reputation is everything. It earns trust, attracts the right partners, and sustains companies long after markets shift.

In our conversation for Leading the Way, Chip reflects on his path from academia to industry, the qualities that define great biotech companies, and the lessons that matter most for leaders navigating uncertainty. He also offers a clear-eyed view of where the industry is headed—and what it will take to keep innovation alive.

You started as a physician-scientist. What drew you into industry?

Chip: As a fellow in Jerry Olefsky’s lab at the University of Colorado’s Health Sciences Center and an Associate Investigator at the VA in Denver, I thought I was destined for an academic career—but getting involved in several clinical studies funded by pharma changed my thinking. I became fascinated by the science and the way the business of science worked. After long conversations with the MSL covering our lab, I realized I could help far more patients in industry than I ever could in academia.

To the horror of my mentors, I turned in my NIH and ADA grants and accepted a position at J&J within a month. I never looked back.

What defines a great biotech company?

Chip: Great companies are built on fundamentals that work in concert.

- It starts with people and reputation. You need smart, experienced people at every level—but talent alone isn’t enough. You have to build a reputation for collaboration, accountability, and trust. In biotech, reputation is your most durable asset.

- Then comes culture. I’ve always believed in authenticity and checking rank at the door. The best ideas should win, not the loudest voices nor those who generally have the most influence. Culture carries you through hard times and accelerates you through the good ones.

- Science is the engine. Incremental progress has value, but great companies push the frontier forward and change paradigms.

- Strong intellectual property is essential. Without it, even the best programs eventually collapse under the weight of capital demands that cannot envision a long-term value accretion outcome.

- Value must be grounded in patient outcomes. The most successful companies stay focused on solving real, unmet medical needs that when addressed will genuinely change patients’ lives for the better.

- And finally, hire ahead of success. The team that gets you to one milestone may not be the one to take you to the next. If you wait to build for growth until it arrives, you’re already behind.

Why is this framework especially relevant today?

Chip: Because biotech is a long, hard business. Investors know this game inside out—they’re masters of pattern recognition. They understand how long product cycles are, how tough regulatory demands can be, and how capital needs explode when science starts to succeed. At that moment, they’ll look at how you’ve built your company. They’ll evaluate your people, your IP, your leadership—and critically, your reputation. That determines whether they believe in you enough to double down when it matters most.

Why is dealmaking so vital to innovation?

Chip: No company can do everything on its own, and it’s getting harder to even try. Licensing deals are one of the smartest ways to bring in non-dilutive capital while adding expertise from a partner who’s already scaled similar challenges. They can also help expand a pipeline far faster than any purely internal effort could.

M&A can be just as valuable, particularly for companies built around a single product or limited resources. The right acquisition can extend your science’s reach and reward your investors and employees for their hard work. The challenge is finding alignment on how you each see both the challenges and opportunities for the future—and negotiating from that shared vision.

You’ve been on both sides of the table. What matters most when negotiating?

Chip: Three things: alignment, transparency and pacing.

- You, your management and your board must be aligned on the key issues and your initial strategy to address them before you start.

- You must be clear with potential counterparties about what you’re trying to achieve. If your goal is to diversify risk, bring in non-dilutive capital, and collaborate with a capable partner, say that openly. It builds trust and respect.

- And pacing is everything. Deals move slowly—until they suddenly move very fast. It’s not speed dating—until it is. When you sense momentum picking up, prepare your board and colleagues to be ready to move the minute the moment turns.

Beyond data, what really gets deals done?

Chip: Reputation and chemistry. Data opens the door, but your reputation determines whether people want to walk through it with you. It’s your credibility, your integrity, and your track record of delivering on what you say. Chemistry is the human layer—it’s how teams connect. When both exist, deals come together naturally.

How do you see deal flow as a signal for the sector?

Chip: Deal flow is picking up, which is encouraging after a long dry spell. But it’s worth remembering that most of these deals reflect innovation that started five to ten years ago finally reaching maturity. It’s a sign of life, not a guarantee of smooth sailing.

Stepping back, how do you see the state of biotech innovation today?

Chip: A year ago, I would have said we were in a Golden Age of Science. But recent policy and political shifts have cast some clouds over that. NIH and NSF funding cuts of up to 50%, leadership changes at HHS that threaten vaccine progress, and senior departures at the FDA and CDC—all have made it harder to maintain confidence in the system. When you layer in the ongoing drug pricing debate, it’s easy to see why so many leaders feel the ground shifting under their feet. The science is strong, but the ecosystem that supports it feels fragile.

What needs to happen to restart the flywheel of innovation?

Chip: We need to get back to fundamentals—reignite the balance between public funding, academic discovery, and entrepreneurial risk. Modernize policy and markets to reward innovation, refocus on people and culture as the true engines of progress, and, above all, rebuild trust. Science only fulfills its promise when people believe in its rigor and leaders defend its integrity.

What advice would you give fellow CEOs navigating uncertainty?

Chip: Take the long view. Focus on execution. You can’t control elections, policy, or markets, but you can control how your company performs and adapts. Keep your team focused on what matters most—patients, data, and disciplined progress—and do those things exceptionally well. That’s always been the key to success in this business.

What inspires you most about the future?

Chip: Despite the challenges, I’m optimistic. We’re in a moment of extraordinary convergence—science, technology, and purpose are aligning in ways that will redefine medicine. The biology is deeper, the tools are sharper, and the mission is clearer. At the end of the day, our job is simple: turn innovation into hope for patients. That keeps me coming back every day.

Waterhouse is a brand reputation agency that helps emerging and fast-growth life sciences companies build competitive advantage. For more information email kkraemer@waterhousebrands.com.